The post Solana Holds Above $150 Amid Mixed On-Chain Metrics: Here’s The Next Price Level For SOL appeared first on Coinpedia Fintech News

Recently, Solana (SOL) has attracted considerable interest as its price has consistently recovered from previous lows. This positive trend followed Bitcoin’s recovery toward the $66,000 mark. Despite this bullish market sentiment, Solana has experienced a decline in its crucial on-chain metrics. However, several metrics continue to build strong buying demand for Solana, creating a mixed sentiment in the market.

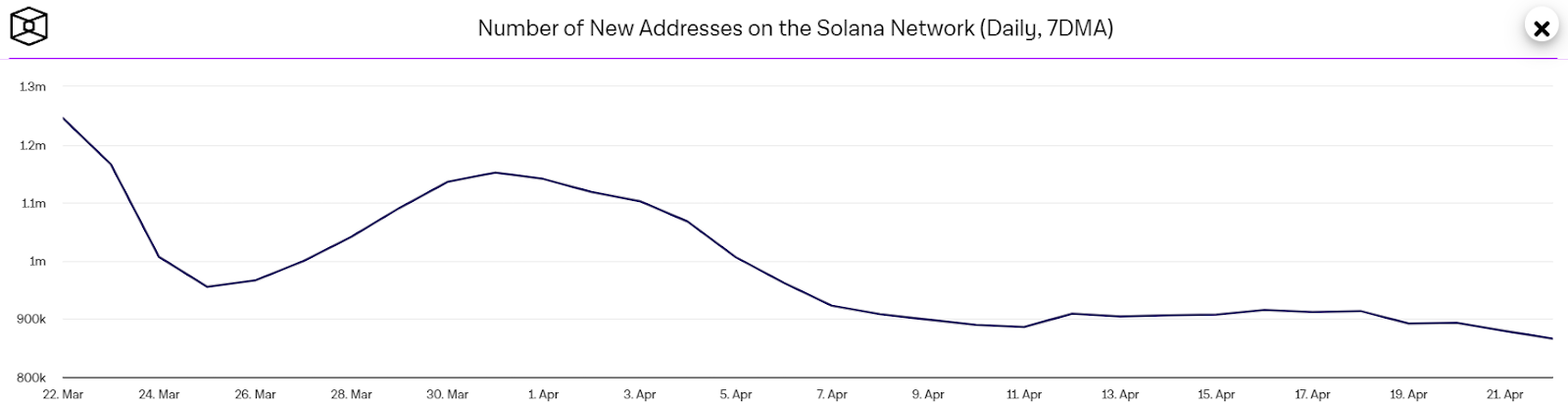

New SOL Addresses Decline By Several Thousands

Currently, the market is experiencing a battle between buyers and sellers as they both try to set a clear price trend for Solana (SOL), which is currently trading within a range-bound ascending channel. As buyers are now gaining advantage, there’s a rise in significant liquidations.

Recent figures from Coinglass reveal that Solana have seen total liquidations close to $6.8 million. Of this total, buyers have faced liquidations amounting to about $2.5 million, whereas sellers have experienced liquidations totalling around $4.3 million.

According to IntoTheBlock data, Solana has seen a significant decline in its number of new addresses. The figures reveal a sharp decrease, dropping from a high of 915,000 to 866,000. This drop in new addresses suggests declining interest in the market to invest in Solana, resulting in a rising bearish sentiment.

There are indications that whales might continue selling, which could lead to further dips in Solana’s price before a solid recovery is observed. It’s not unexpected that both Solana and the market are currently unstable, especially considering the pressure on miners following last week’s Bitcoin halving.

According to data from IntoTheBlock, the value transferred on-chain has been increasing. The metric recently recovered from a low of $64 billion and reached $90 billion today, indicating continued buying demand.

The long/short ratio has decreased to 0.8512, indicating growing bearish dominance as 54% of positions now anticipate a decline in SOL price.

What’s Next For SOL Price?

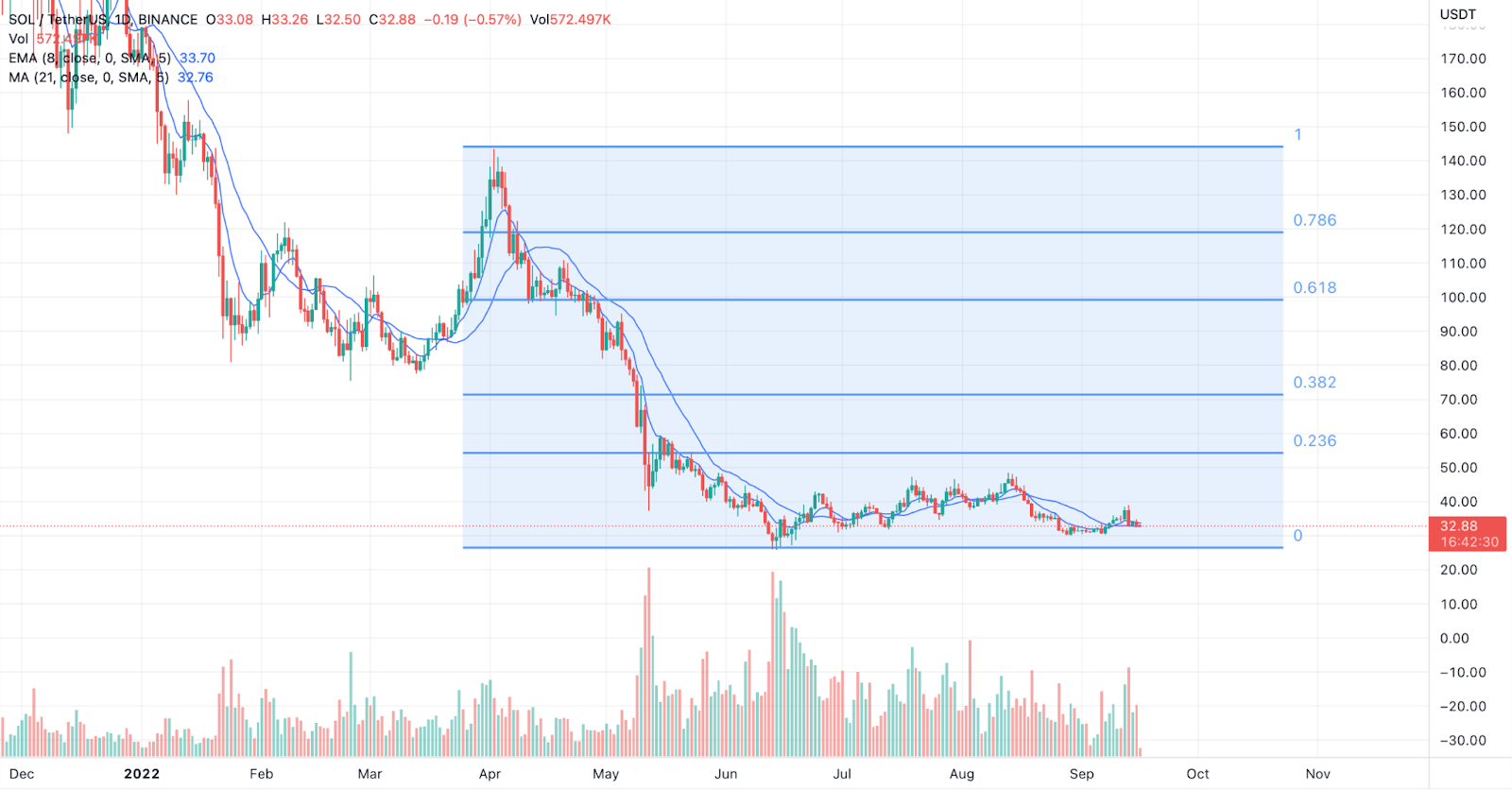

Solana has reached its 200-day Exponential Moving Average (EMA) at $158 on the 4-hour chart, which is likely to act as a significant resistance point. Buyers have been accumulating aggressively in the last few hours, breaking above immediate Fib levels. As of writing, SOL price trades at $158.1, surging over 3.3% in the last 24 hours.

If the price advances past the moving averages and $162, it signals a potential comeback by the bulls. In this scenario, the SOL/USDT pair may aim for a rally towards the next major resistance at $192.

If the price declines from the moving averages, it indicates surging negative sentiment and that traders are selling during price rallies. This could lead the price to drop towards the solid support level at $126. If it breaks below this threshold, there could be a further decline to $100.

As the RSI level rises, remaining below the overbought threshold, the price of SOL could continue its upward momentum, potentially retesting its previous breakdown point.