The post Ripple vs SEC-Final Countdown Begins, Will Exchanges Relist XRP or Will Price Miss Another Bull Run? appeared first on Coinpedia Fintech News

XRP appears to be largely unaffected by the ongoing bearish market sentiments as the prices continue to hold the crucial $0.39 levels. The positive market sentiments are slowly coiling up for the crypto as the latest hearing of the LBRY vs SEC lawsuit has planted fresh hopes of victory.

As previously mentioned by Coinpedia, January 30-LBRY’s hearing was extremely crucial for the Ripple vs SEC case. John Deaton, the XRP army representative in court placed a strong argument due to which LBC tokens were declared ‘not security’ by the judge. The repercussions of this case are expected to display in the Ripple vs SEC case which is expected to find its closure soon.

With the positive outcomes of the lawsuit emerging, the XRP price gained significant bullish momentum, The weekly chart of the XRP is painted in green, while the resistance is closer to the support. Once the price strikes the resistance, a bullish trend may begin in form of Wave 3.

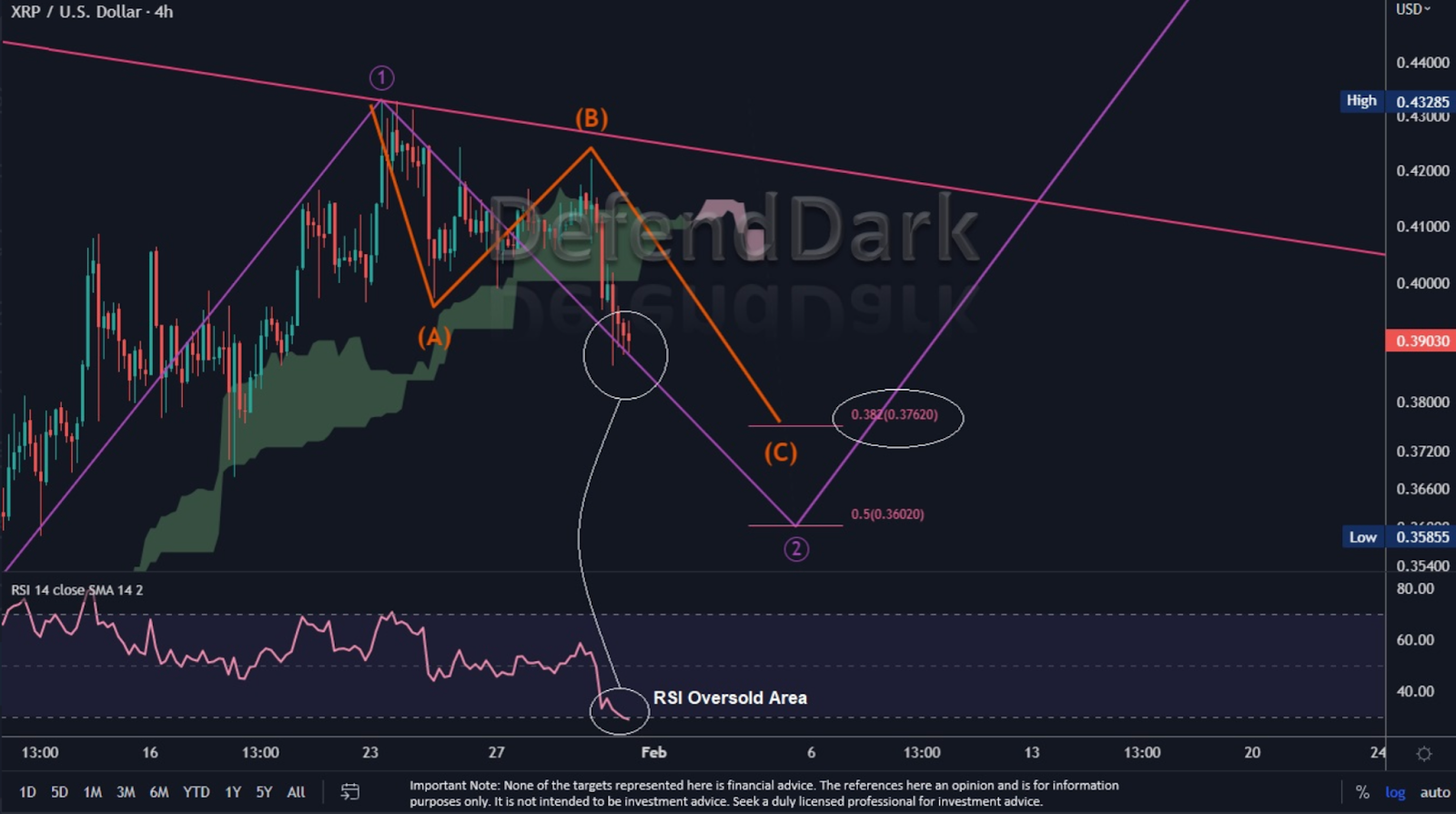

A popular analyst anonymously called ‘Dark Defender’ referring to the above chart says that the XRP price with the current rebound has begun its journey in Wave C. Therefore, continuing within the same trend may result in the price slicing through $0.4 levels and marking highs around $0.42. He does, however, include a bearish clause and warns that in the event of a rejection, the price must hold the $0.3762 and $0.3602 levels.

“Hi there, XRP started & touched $0.38593 with Wave C. We are tried $0.42 & couldn’t break.

RSI in 4H says we are in the oversold area; however, let’s keep an eye on both $0.3762 & $0.3602.

We’ll welcome Wave 3 in days. Cheers!”

Therefore, the crypto markets, specifically the XRP price appears to have been surrounded by positive market sentiments and hence a significant upswing could be imminent.