The post Tether’s (USDT) Market Cap Declines by Nearly $5B, Still Failing to Re-Peg at $1! appeared first on Coinpedia Fintech News

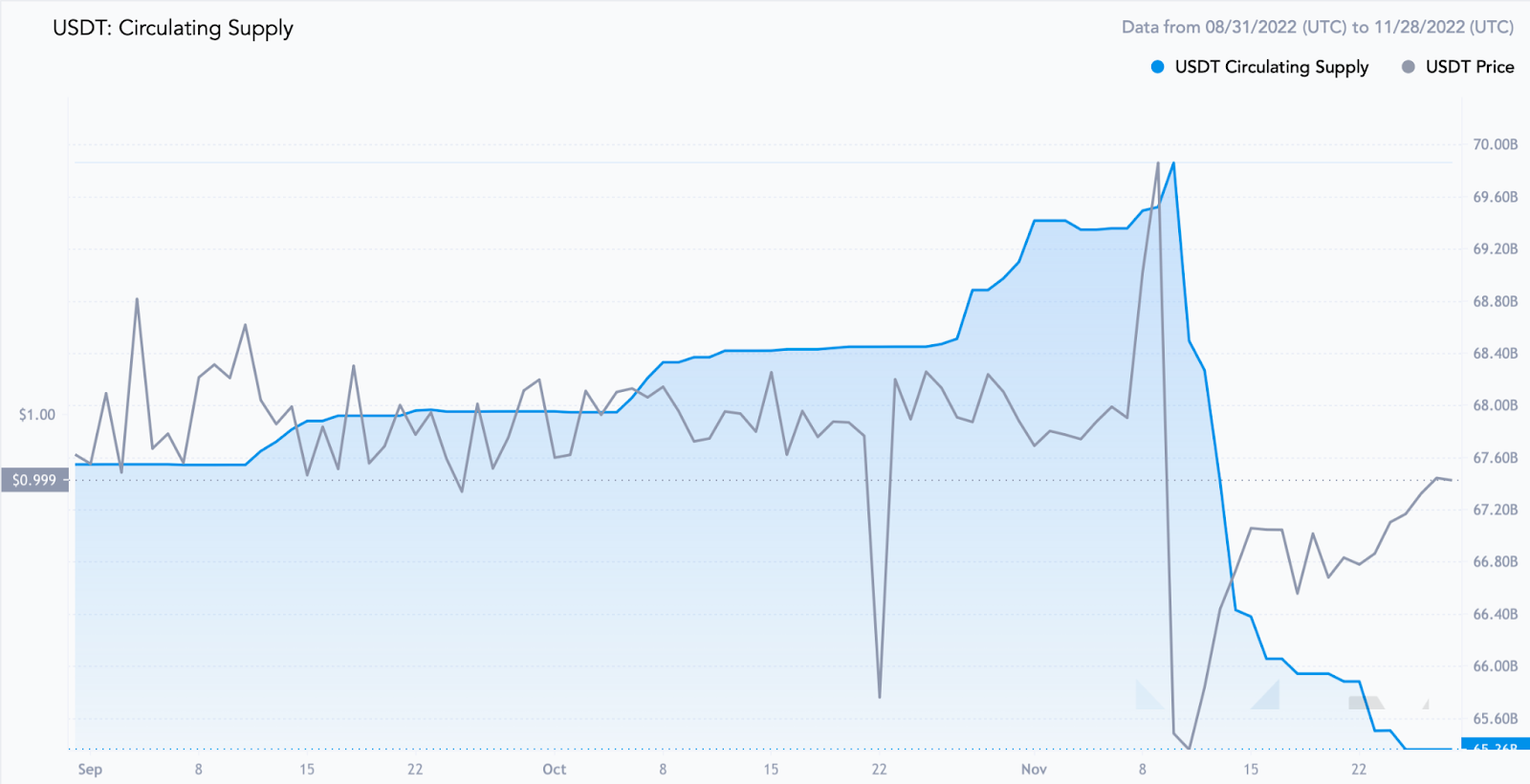

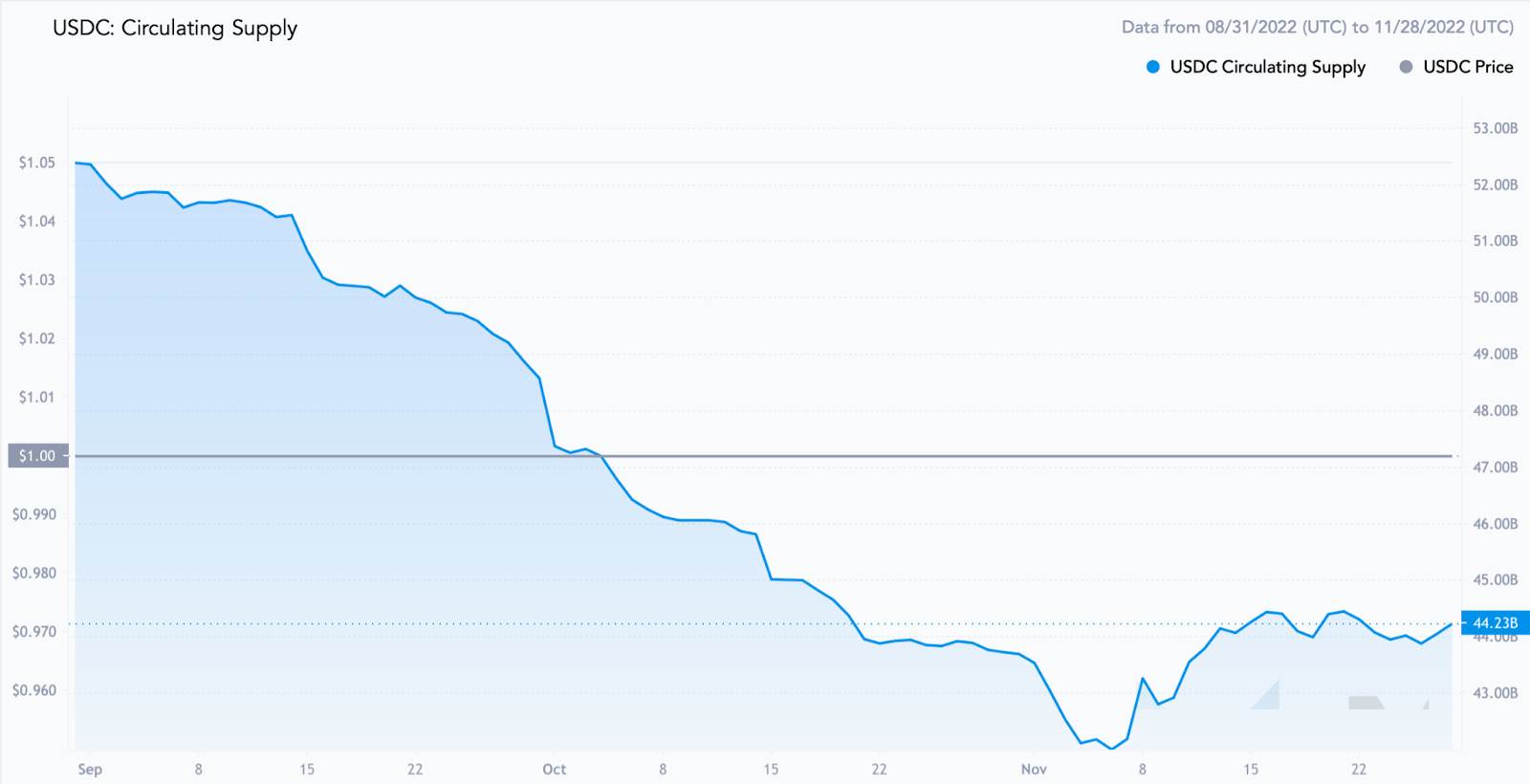

The top 2 stablecoins, Tether(USDT) and USD Coin (USDC) have yet again gained massive attention as a probable shift in the supply is witnessed between the two. The market capitalization of USDT has slashed heavily in the past seven days, losing nearly $5 billion. USDC’s market cap, on the other hand, was plunging but reversed the trend at the earliest.

A potential shift in the supply is seen with the top 2 stablecoins USDT and USDC as the circulating supply of prior was slashed and the supply of USDC raised notably. Ever since the May crash, the supply of the top stablecoin has been slashed heavily. Meanwhile, the asset also constantly lost its peg and hence to regain its peg, billions of USDT were just destroyed.

The fresh market crash led by the collapse of the popular FTX exchange has adversely impacted the USDT price. The price dropped to mark lows around $0.997 and continues to trade below $1 until the press time. Meanwhile, efforts were carried out to raise its value burning the circulating supply by nearly 5 billion, but the price failed to reclaim $1. Besides, the circulating supply of USD Coin has been raising notably which raises the possibility of a probable shift of market share from USDT to USDC.

Comparing both charts, it is quite evident that the circulating supply of both assets has been varying at the same time. While USDT lost nearly 5 billion tokens and around a $5 billion market cap, USDC has gained nearly the same value. Additionally, USDC is maintaining its peg at $1 regardless of the ongoing bearish market sentiments.

Therefore, with this, it can be determined that USDC is emerging as a leading stablecoin and hence may surpass USDT to become the leading asset after Bitcoin and Ethereum.