The post Litecoin Shows Bullish On-chain Metrics Amid Bearish Post-Halving Trend! Will LTC Price Skyrocket Soon? appeared first on Coinpedia Fintech News

After the halving event, Litecoin’s value experienced significant volatility, quickly dropping below key support levels. While many anticipated a bullish turnaround for LTC from these bottom positions, it lacked the necessary purchasing momentum. Yet, current on-chain metrics hint at whale players silently making their move, possibly in anticipation of a robust bullish surge in the upcoming weeks.

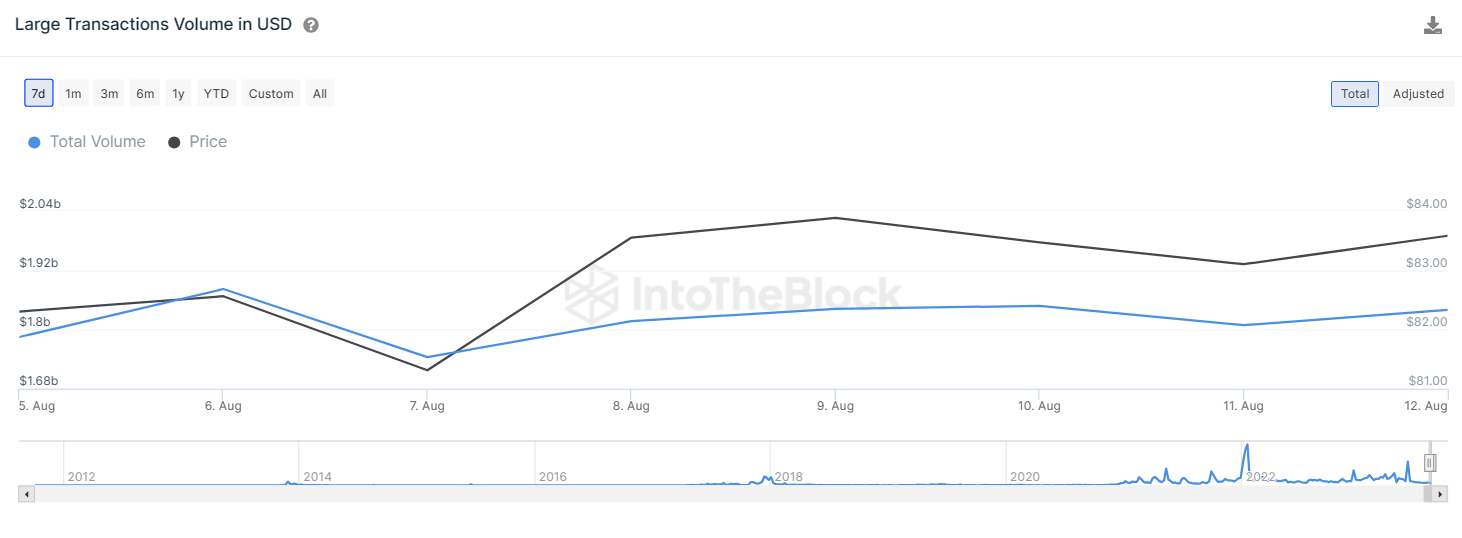

Litecoin’s Large Transaction Volume Continues To Pump

Recently, Litecoin (LTC) has been making waves with its steadily increasing transaction volume, suggesting a renewed interest among traders. According to IntoTheBlock data, Litecoin’s large transaction volume has been increasing over the last 7 days. The volume has surged from $1.74 billion to $1.84, hinting that whale players are investing in the LTC market near the current dip.

A consistent increase in volume often precedes a bullish trend, as it indicates strong demand and positive sentiment among traders and investors. Moreover, it can trigger a heavy short-liquidation if the LTC price makes an upward surge due to buying pressure.

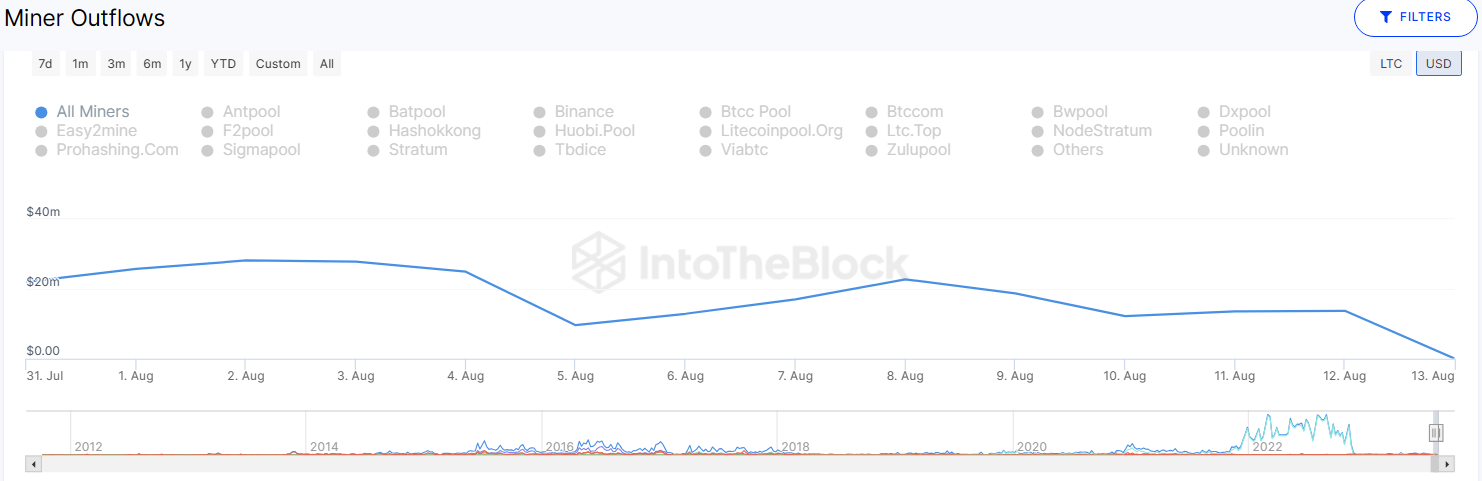

In addition to the existing positive indicator, there’s another factor that might boost the bullish momentum for Litecoin: the recent behavior of its miners. Data suggests a significant shift in miners’ actions, particularly regarding their selling habits.

Over the past fortnight, there’s been a marked reduction in the outflow from Litecoin miners. Specifically, the metric, which measures the amount of Litecoin being moved out of miners’ wallets, has seen a substantial decline. It plummeted from a peak of $28 million to a much lower $13.7 million.

With fewer Litecoins being sold by miners, there’s a potential tightening of the coin’s supply in the market. A reduced supply, coupled with steady or increasing demand, can exert upward pressure on the price. It’s worth mentioning that the total supply cap for LTC is 84 million, with 73 million Litecoins already in circulation.

What’s Next For LTC Price?

Litecoin faces challenges in initiating a rebound from the robust support level of $80, indicating a lack of buying pressure near higher levels of $85.

The declining 20-day EMA at $82.8 on the 4-hour price chart, coupled with the RSI below the midline suggest that the bears currently dominate. If the LTC price slides and fails to hold above $80, it would hint at a solid downward correction. The next support levels to monitor are $74 followed by $65.

On the flip side, the primary resistance to observe on the upward trajectory is $85, which is the upper hand of the consolidation zone. If the price is driven above $88 by buyers, it could indicate the onset of a more substantial recovery, potentially reaching $97. However, this price point might witness intensified selling pressure.

Past performance suggests hope for bulls. After the 2019 Litecoin halving, LTC surged to $400 in 2021, despite dropping from $66 to $35 in December 2019.