The post Dogecoin’s Flat NVT Ratio Hints At Undervaluation Amid Price Surge! What’s Next For DOGE Price? appeared first on Coinpedia Fintech News

The meme coin market is pumping hard, triggered by Bitcoin’s recent surge towards the $64K level. Particularly noteworthy is Dogecoin, which has surpassed its resistance channels and recently reached the highly anticipated milestone of $0.1. However, the latest on-chain analysis indicates that there may be more room for growth for the meme coin, as a crucial indicator points to undervaluation despite its skyrocketing rise.

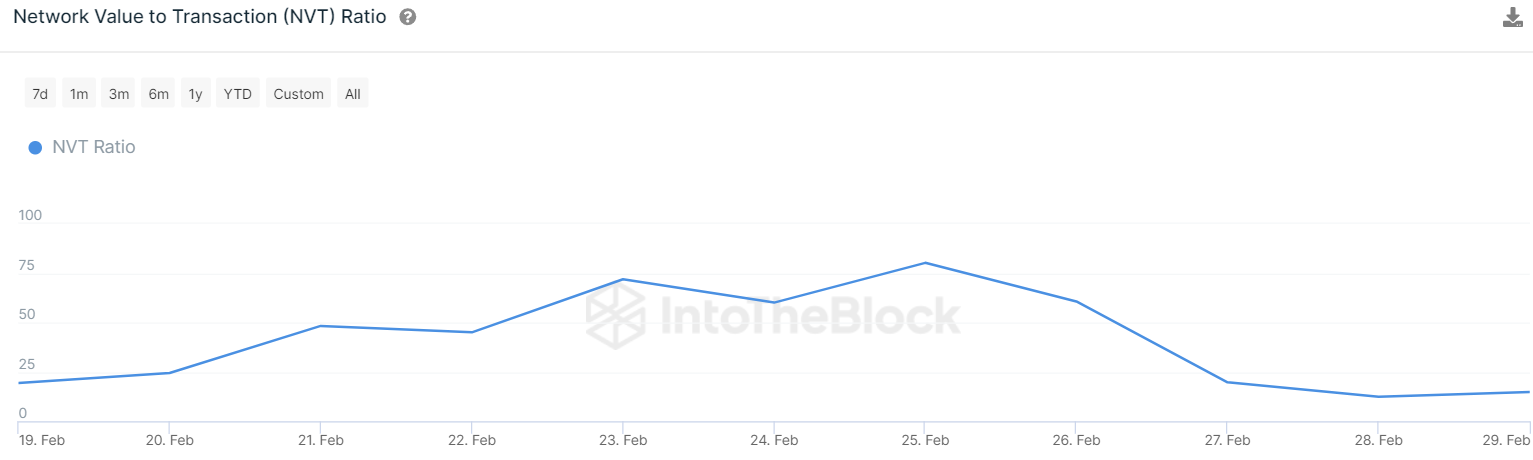

DOGE’s NVT Ratio Declines Amid Price Surge

In the last 24 hours, the cryptocurrency market saw a notable rebound following a recent flash crash, resulting in the liquidation of almost $280 million in positions. This recovery in market prices was prompted by increased accumulation near support lines by holders. Particularly noteworthy is the liquidation of approximately $50 million in short positions within a 12-hour timeframe, alongside Dogecoin facing liquidations exceeding $3 million, with sellers accounting for around $2.2 million of this total.

Nevertheless, even though Dogecoin’s price is presently trending upwards, multiple on-chain indicators imply that this surge may not be sufficient, as DOGE price is poised to achieve additional gains. As per IntoTheBlock data, the NVT ratio has been decreasing and currently sits at 14.87.

This indicates that despite the recent increase in network value, transaction volume has continued to rise alongside the increased network value. This shows investor confidence and a surge in activity surrounding DOGE price, hinting at potential for further gains in the days ahead. Top of Form

On the other hand, Dogecoin shows a surge in the MVRV ratio (Market Value to Realized Value), which currently stands at 1.4. This indicates that Dogecoin’s market value is surpassing its realized value, representing the value at the last transaction. This came about as long-term holders are increasingly confident and reluctant to liquidate their positions at this time. While it boosts buying confidence, there is a possibility that STHs might initiate a correction.

What’s Next For DOGE Price?

Efforts made by sellers to revert Dogecoin back into the symmetrical triangle pattern faced resistance from buyers, resulting in a rebound from the 20-day EMA trend line. Presently, Dogecoin is valued at $0.126, marking a decrease of over 0.82% from yesterday’s rate.

The 20-day Exponential Moving Average (EMA) has surged to $0.115 and is currently following an upward trajectory, along with the overbought Relative Strength Index (RSI) level. This suggests a bullish dominance among DOGE traders.

Should Dogecoin hold above the moving averages, it may break the immediate resistance at $0.135. However, there are concerns of pullbacks that might slow down the bullish momentum. If DOGE price fails to break the $0.135, we might see a surge in selling pressure and aim for a retest of $0.1.

Conversely, if buyers succeed in sending the price above $0.135, the next resistance for DOGE price will be around the $0.17 mark.