The post Bitcoin Price Movement Causes Concern! A Close Above These Levels Could Revive Bullish Expectations appeared first on Coinpedia Fintech News

The Bitcoin price trend is extremely unsettled and uncertain ever since the market collapsed in May 2022. While multiple attempts to revive the bullish trend were made but woefully, it ended up in a significant leg down. Furthermore, both the market participants and the whales have turned out to be less confident about the upcoming rally, which may adversely impact the buying pressure.

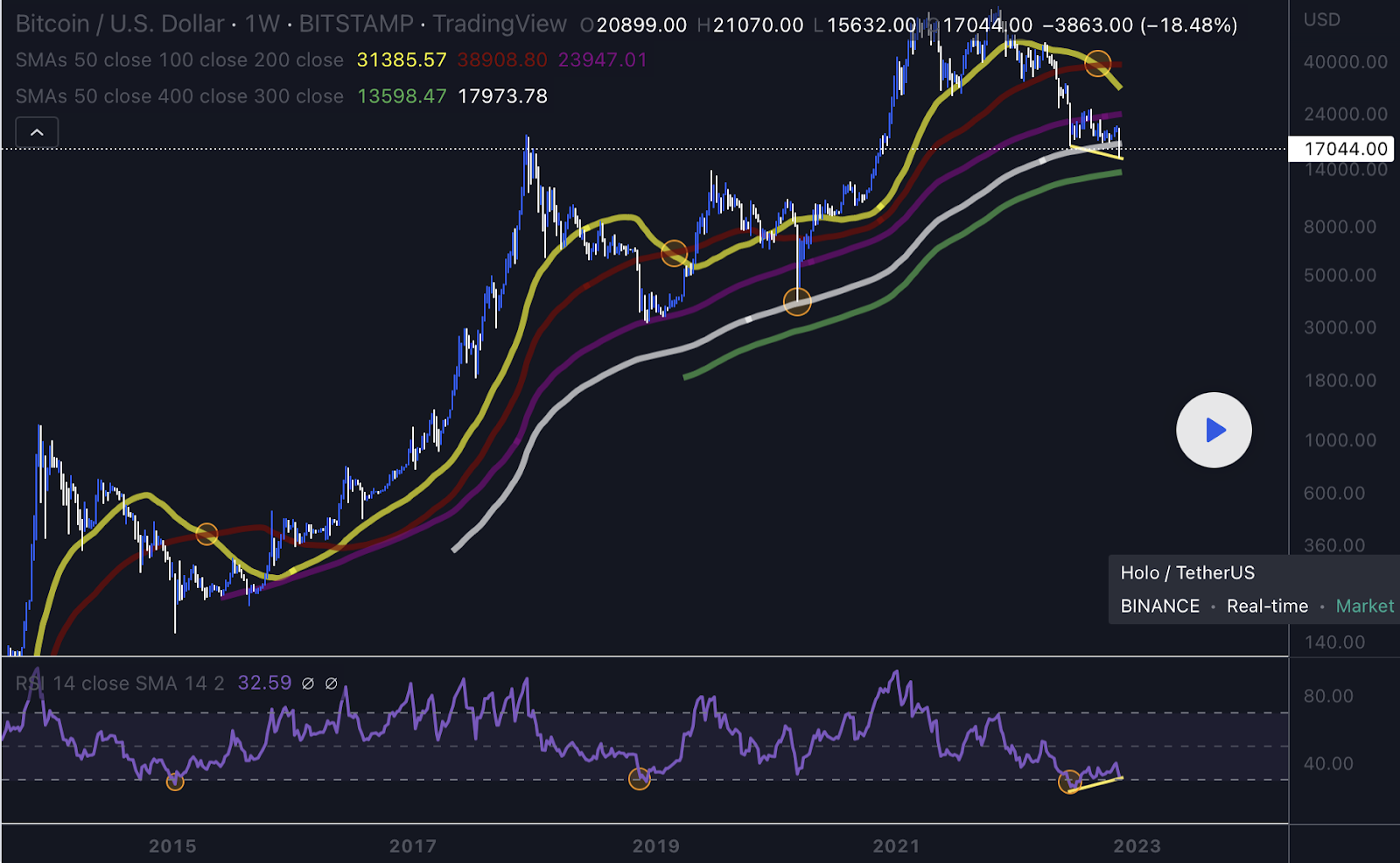

Amid the fresh sell-off, the BTC price has breached the 300-week moving average levels for the first time ever. The first time it touched these levels was during the COVID crash in 2020, but it did not slice through the levels and rebounded strongly. For now, when the levels are breached, a significant downswing may be fast approaching.

But wait there is a catch!!

Along with a drop below 300-Week MA levels which is painted in white, a bullish cross between the 50-day(Yellow) & 100-day(Red) MA levels is witnessed. This cross signalled the end of the bear market previously which had ignited a significant upswing to mark new highs. Therefore, a similar price action is assumed to undergo now, but the breach through 300-Week MA is concerning.

Well, Bitcoin is not only battling the Moving Average but it just breached it substantially. It is not that all is lost yet as the weekly close is yet to accomplish. Therefore, a bullish close above $18,000 may invalidate the bearish trajectory to pave way for the bulls to ignite a recovery phase at the earliest.

Fortunately, the RSI is displaying a bullish divergence, and hence, it would be quite interesting to watch how this may impact the BTC price in the future. However, in the case of the bearish wave impulsion, the lower support at the 400-Week MA around $13,700 may hold the price tightly so that Bitcoin may bounce off the bearish captivity.