The post Bitcoin Price Prediction: BTC to Move Below $18,500 in the Next 12 hours! appeared first on Coinpedia Fintech News

Ever since the markets collapsed with the LUNA-UST crisis, the markets have been reacting negatively to the release of CPI rates. While inflation has reached a 40-year high, the FED is bound to increase the rates. As a result, the stock markets and crypto markets may face adverse action very soon.

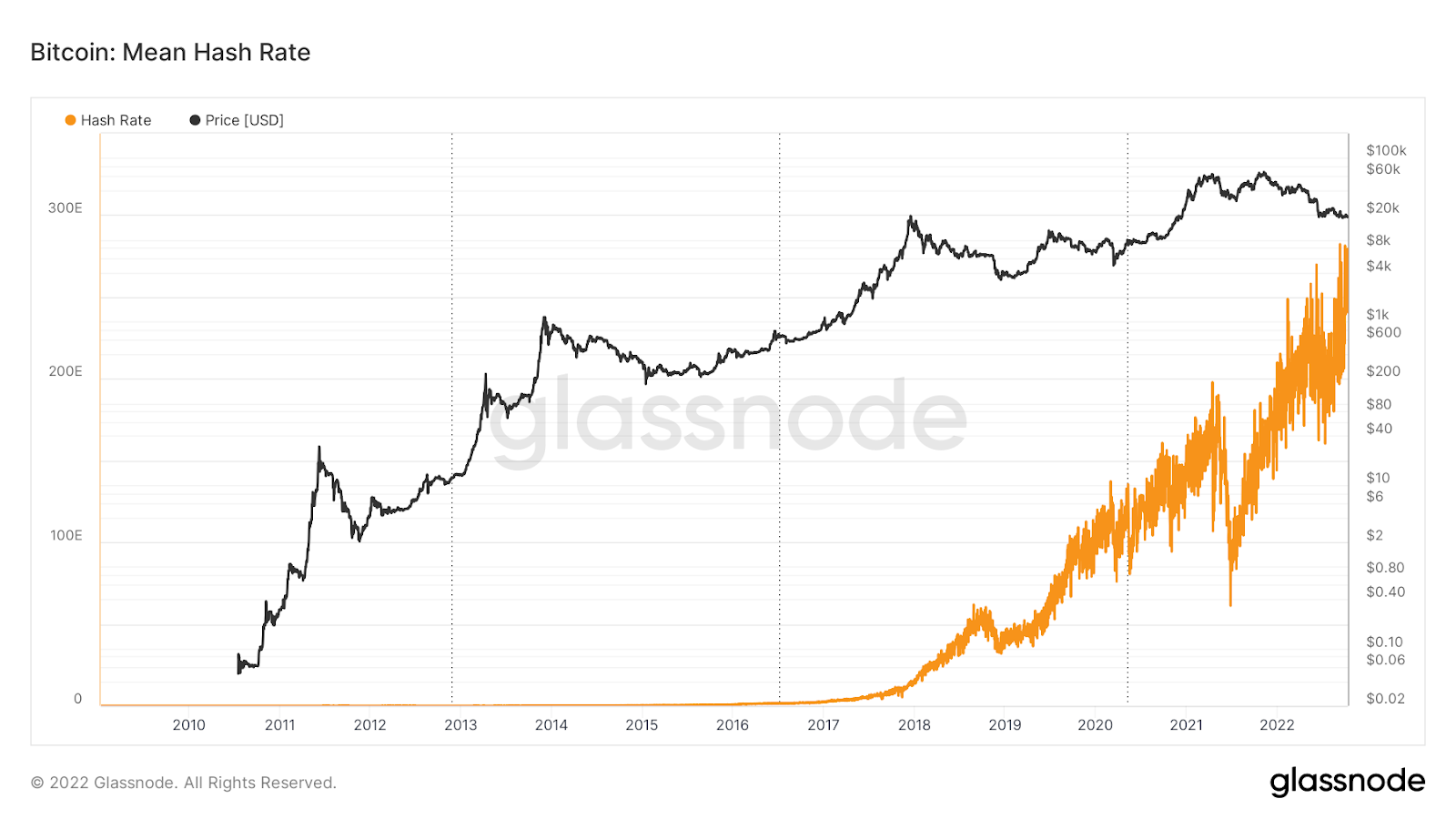

On the other hand, Bitcoin mining is reaching the skies and recorded highs at around 285THs recently. As a result, the miners may now be under immense pressure as the mining activity may become costlier than before.

As the BTC price is slumping hard and may not resist the rising mining costs, the risk of miners’ capitulation may potentially increase. Moreover, if the miners continue to hold large amounts of Bitcoin, then this may eventually bring down the BTC price in the upcoming days.

Additionally, with the recent price action, the asset is now trading within a huge bearish flag and testing the lower support.

The BTC price has previously tested the lower support but the bulls were quite strong enough to ignite a rebound. But in the present case, the bears have capitulated to the rally and hence the price may eventually drop hard. As a result, the BTC price may breach through the lower support following the release of the CPI data and bottom out close to the yearly lows.

However, ever since Bitcoin’s (BTC) price bottomed below $18,000, the bulls have held the token firmly above the levels. Therefore, the star crypto is expected to drop significantly, which may be quickly followed by a strong recovery.