The post Traders Fall Into FUD Trap; Whales Profit from Panic Selling Opportunity! Will the BTC Price Face a Negative Impact? appeared first on Coinpedia Fintech News

The crypto markets have reached a phase where each dip offers a new opportunity to accumulate more. It has happened before that traders soon fall into the FUD trap as they become uncertain after a 7% to 10% drop in the Bitcoin price. In such times, the recent upswing usually goes unnoticed, and the whales profit from these situations and prepare themselves for the next price action.

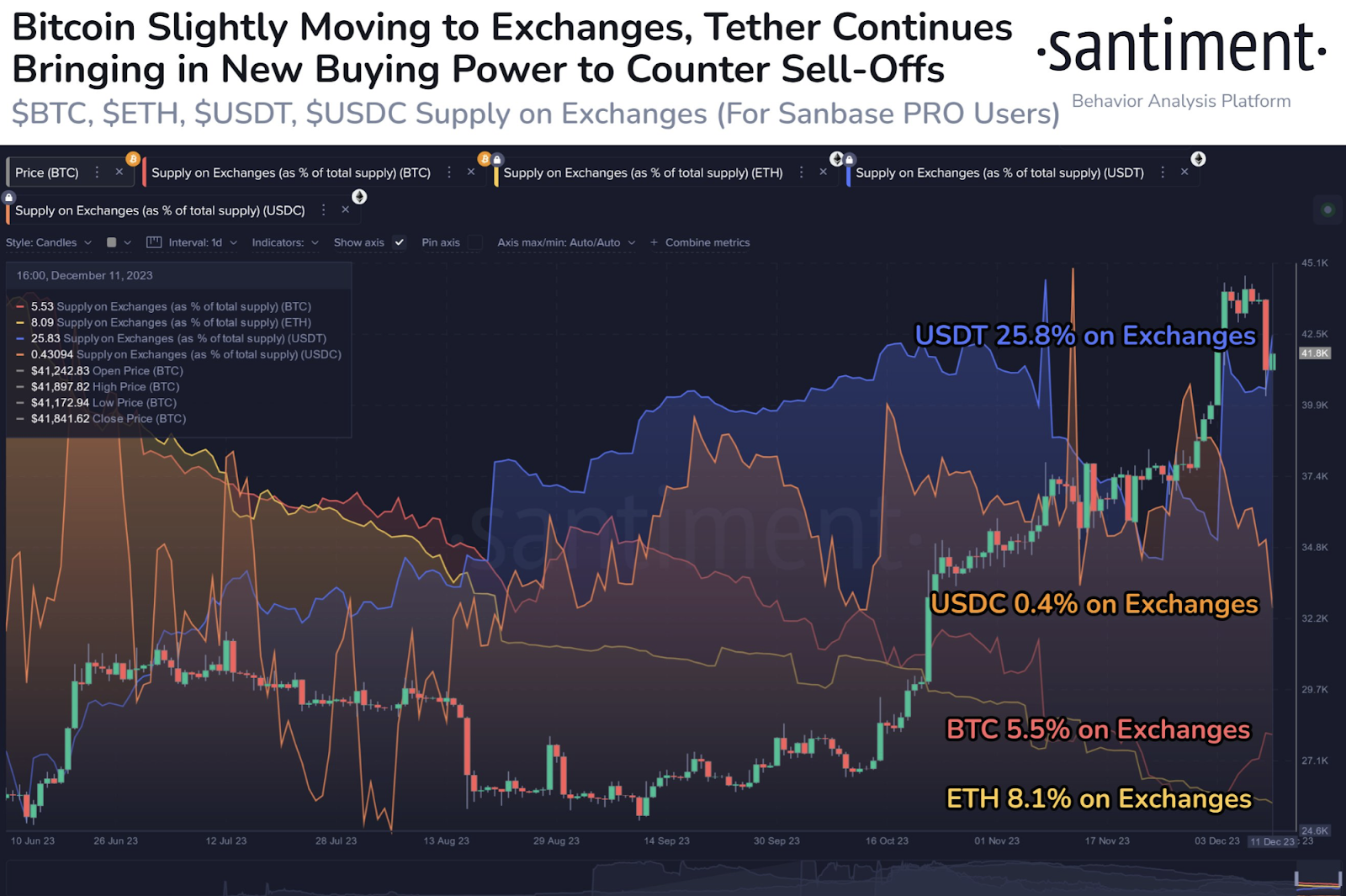

The recent market conditions suggest that traders have become uncertain as more than $100 billion has been wiped out of the markets. With this, the traders’ sentiments have also made a significant shift as Bitcoin is flowing back to the exchanges. The data from Santiment suggests the BTC supply on exchanges has again soared to 5.5% of the total supply.

The above chart shows a minor drop in the USDT, USDC, and ETH balances, while the BTC balance made a notable rise. However, USDT remains the leader in this prospect, as nearly 6.9% more USDT is present on the exchanges at present compared to the levels six months ago. This has offered an opportunity for the whales to accumulate BTC at a discounted price.

In the wake of the recent Bitcoin price dip, a noticeable uptick in the number of entities holding 1000 BTC or more has been witnessed. This increase suggests that BTC whales are seizing the opportunity to accumulate more before the beginning of the next bull run. This may drag the Bitcoin price slightly lower and find itself in one of the crucial support zones between $37,150 and $38,360, as 1.52 million addresses hold nearly 534,000 BTC.

Hence, if the token faces extreme heat and fails to hold these levels, a fresh bearish wave may squash all the bullish possibilities within the crypto space for some time.