The post Shiba Inu Regains Its Monthly Volatility Peak Of 64%: Will Bulls Hold SHIB Price Near Resistance? appeared first on Coinpedia Fintech News

Amidst a market correction where Ethereum and Bitcoin have recently witnessed a rebound after a decline of less than 5% in value over the past 24 hours, Shiba Inu has notably bucked the trend with a 12% increase in price over the last two days. This upward movement is particularly interesting as it comes alongside a substantial surge in the burn rate volume and a monthly high in volatility rate.

SHIB’s Open Interest Surges After 4 Months

The open interest in Shiba Inu made a significant increase in August, following the start of the current bull run. Yet, in the following months, there has been a notable decline in Shiba Inu’s open interest despite the overall OI rise in other assets. However, SHIB has now regained its momentum as its open interest is now again on a surge, touching a 4-month high of $27 million.

However, Shiba Inu’s market behavior is unique, with its price not closely tied to its open interest, unlike Bitcoin and Dogecoin. Despite lower open interest historically, SHIB’s price remains stable, suggesting that open interest fluctuations might not heavily influence its price. However, SHIB still closely follows Bitcoin’s trends, indicating that a surge in Bitcoin’s value could significantly affect SHIB’s price.

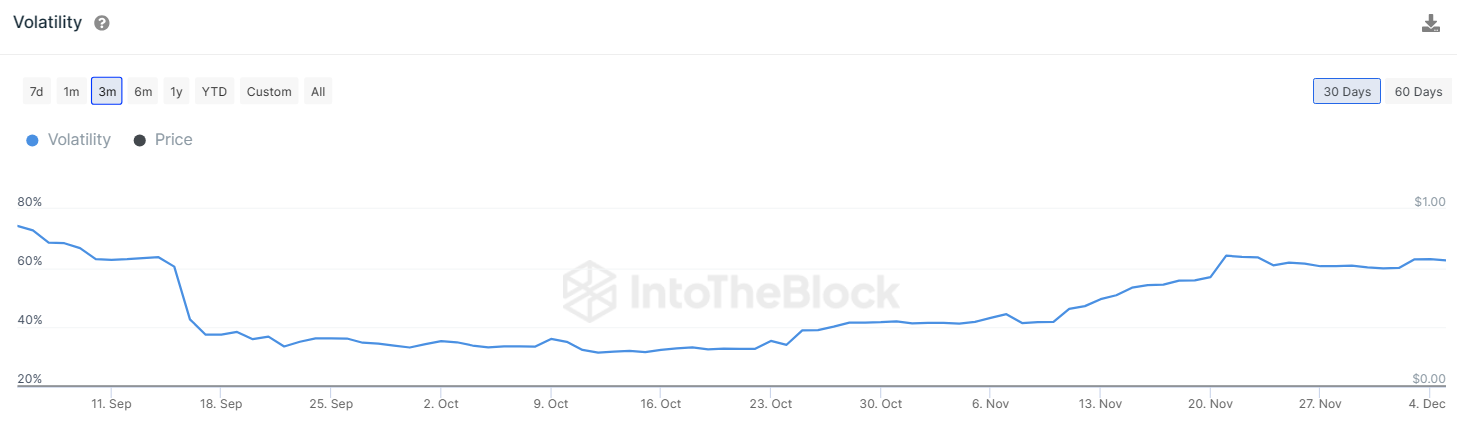

According to information from IntoTheBlock, Shiba Inu has reached a monthly peak in volatility, hitting 64%. This increase brings a 20% rise to SHIB’s value over a month. The growing volatility could potentially draw in more traders, pushing open interest. Such a development could lead to a big market movement, especially if SHIB breaks through its current resistance levels.

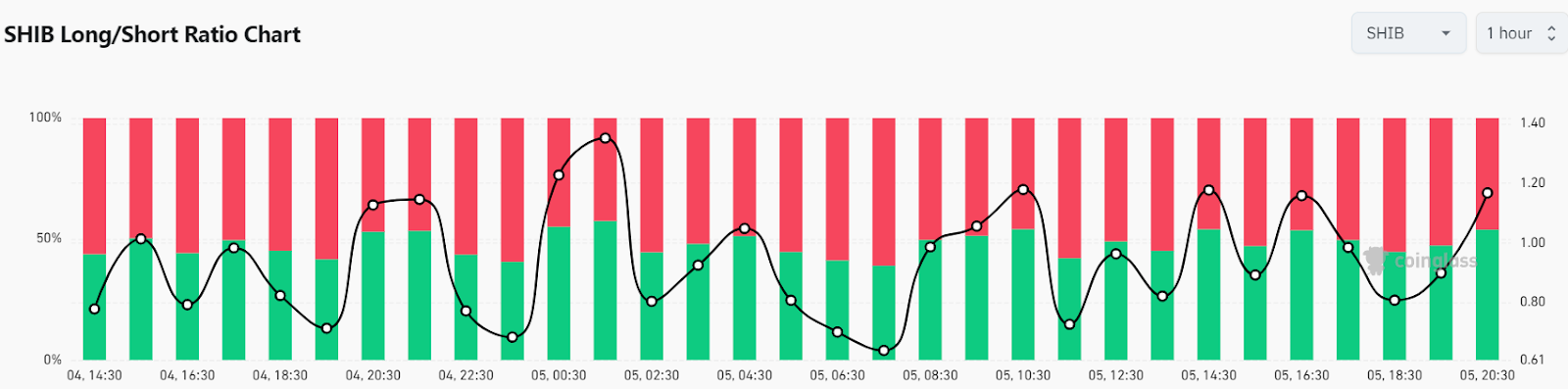

Currently, the market is showing bullish signs, as seen in the rising long/short ratio, trading at 1.1673. This indicates a consistent increase in long positions, with 54% of them anticipating a rise in prices.

What’s Next For SHIB Price?

Shiba Inu has recently faced a resistance at $0.0000097 as buyers liquidated their holdings to lock their profits. However, they are now strongly defending a decline below $0.0000087, suggesting an accumulation zone. As of writing, SHIB price trades at $0.0000094, surging over 4.9% from yesterday’s rate.

The upward slope of both moving averages and the RSI nearing the overbought zone at 63, suggests that SHIB price is more likely to continue its upward trend. The SHIB price is poised to potentially rally towards the key $0.0000097 mark. However, a strong resistance is anticipated in the $0.00001 region.

On the downside, the 20-day EMA at $0.0000089 is a crucial level to monitor. Should there be a break and close below this level, it would indicate profit-taking by the bulls, potentially leading to a decline towards $0.0000075.

With Bitcoin’s price currently holding above the $42K mark, there’s a possibility that the price of SHIB could gain momentum and potentially break through key resistance levels.